1 April 2024

Cantab Asset Management

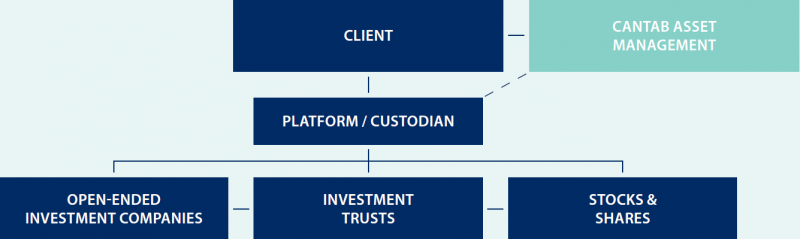

Cantab Asset Management (‘Cantab’) advises on asset allocation, fund manager and stock selection. Cantab can implement this advice for clients through either advisory or discretionary management arrangements. Additionally, Cantab provides support services such as financial planning, custodian selection and consolidated reporting across all investment portfolios.

Cantab is ‘independent’ in regulatory terms as defined by the Financial Conduct Authority. This means that Cantab considers the whole of the market for clients. Cantab has developed an Open-Ended Investment Company (‘OEIC’) to benefit clients with additional structural options for holding investments. Cantab does receive an investment management fee from the OEIC and so has a ‘conflict of interest’ which is declared and transparently addressed in the Client Agreement.

Custodian and Platform

The custodian, selected by Cantab in discussion with the client, holds the investments and often provides stockbroking services. This structure facilitates efficient execution of trades and client assets are segregated from Cantab’s own assets.

Investments

Cantab may recommend fund managers for stock and bond selection where a manager’s specialist expertise is considered to be of value. Fund structures may include OEICs, Unit Trusts, Investment Trusts and Exchange Traded Funds (ETFs). Cantab researches over 3000 collective funds, 300 Investment Trusts and 700 ETFs.

Cantab may select individual equities and bonds using investment research from in-house and external resources.

Cantab researches over 2000 shares using its own proprietary ‘CAMBRIDGE’ method for analysing individual shares.

Investment Research

Cantab has a team of analysts who conduct internal research and also access material from third parties. The analysts report to the Sector Heads for Funds, Investment Trusts and Equities. Reports are prepared each quarter for the Investment Committee and decisions on asset allocation, fund and stock selection are made by the Committee. There are provisions for interim decision making between meetings where applicable.

To discuss in more detail, please contact us.

Risk Warnings. This document has been prepared based on our understanding of current UK law and HM Revenue and Customs practice as at 1 April 2024, both of which may be the subject of change in the future. The opinions expressed herein are those of Cantab Asset Management Ltd and should not be construed as investment advice. Cantab Asset Management Ltd is authorised and regulated by the Financial Conduct Authority. As with all equity-based and bond-based investments, the value and the income therefrom can fall as well as rise and you may not get back all the money that you invested. The value of overseas securities will be influenced by the exchange rate used to convert these to sterling. Investments in stocks and shares should therefore be viewed as a medium to long-term investment. Past performance is not a guide to the future.